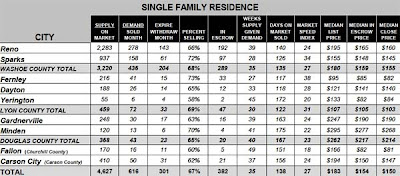

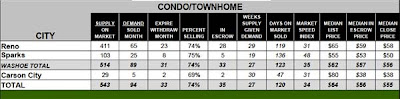

OVERVIEW: Both SFR and Condo supplyare very constant in the current range with slight positive propensity. This means that as properties are moved off the market by either becoming a sale pending or a failure, those properties are being replaced by new supply. At the same time, properties in escrow continue to build in a slow methodical way. This implies that the level of closed demand will be increasing in the near term in small steps (no big moves). Prices for SFR continue very weak and in decline; Condo has steadied in the current range.

WEEKS SUPPLY GIVEN DEMAND (ABSORPTION RATE): The absorption rate has stabilized with a slight negative propensity for both types. Tightening absorption rates signal a tighter market. However, current changes in the absorption rate are small and not significant.

MARKET SPEED INDEX: Market speed (the conversion of listings to closings) has remained relatively constant for the last several months. The pace of the Reno area market is slow and steady with no big variations from month to month.

PRICES: SFR prices continue to decline while Condo has stabilized in the short run. Prices are erratic from month to month and seem to gyrate in a narrow range (see History of Median Sale Price Graph). Note in the price graph that the tail end of the trend lines shows a definite decline. Notice also that the above mentioned erratic nature of the price curve is more is less pronounced and more predictable in the latter time periods.

No comments:

Post a Comment